Client Money Handling Policy and Procedures

- We have set up a separate bank account for clients’ money; This account is a segregated account authorised by the Financial Conduct Authority (FCA) for this purpose.

These are examples of Client Money

- Tenant Deposit

- Tenant rent

- Interest

- Arbitration Fee

- Service Charges

- Fee Money Taken in Advance

- Client Money held due to be paid to Contractors

- Sale Proceeds

- Money held by member appointed as a receiver.

- The account is easily identified as Oak County Property Management Client Account and is distinguished from other accounts of our business.

- We have it in writing from our bank confirmation that all money is held

by the business as an agent.

- We have our banks written confirmation that our bank is not entitled to combine the clients’ money account with any other account or to exercise right of set-off or counterclaim against money in that account in respect of any sum owed to it or any other account of the business.

- We have and maintain systems and controls which enable us to monitor and manage clients’ money transactions and any credit risk arising.

- We have accounting systems and client data securely controlled and protected.

- We obtain client’s written approval to make payments from their account.

- We bank all clients’ money at the earliest reasonable opportunity; Any money taken as cash must be deposited in the Client account within 3 working days

- We nominate authorised staff to handle money

- Whilst if in not normal policy to handle cash We ensure that records show any and all cash transactions.

- Any unidentifiable transactions are treated as client money until they are identifiable and verified otherwise.

- We reconcile client accounts together with bank and cash balances at regular intervals in order to demonstrate control over the accuracy and completeness of accounting records.

- We ensure there are always sufficient funds in the account to pay all amounts owing to clients; and

- We pay amounts owing to clients as they fall due without delay.

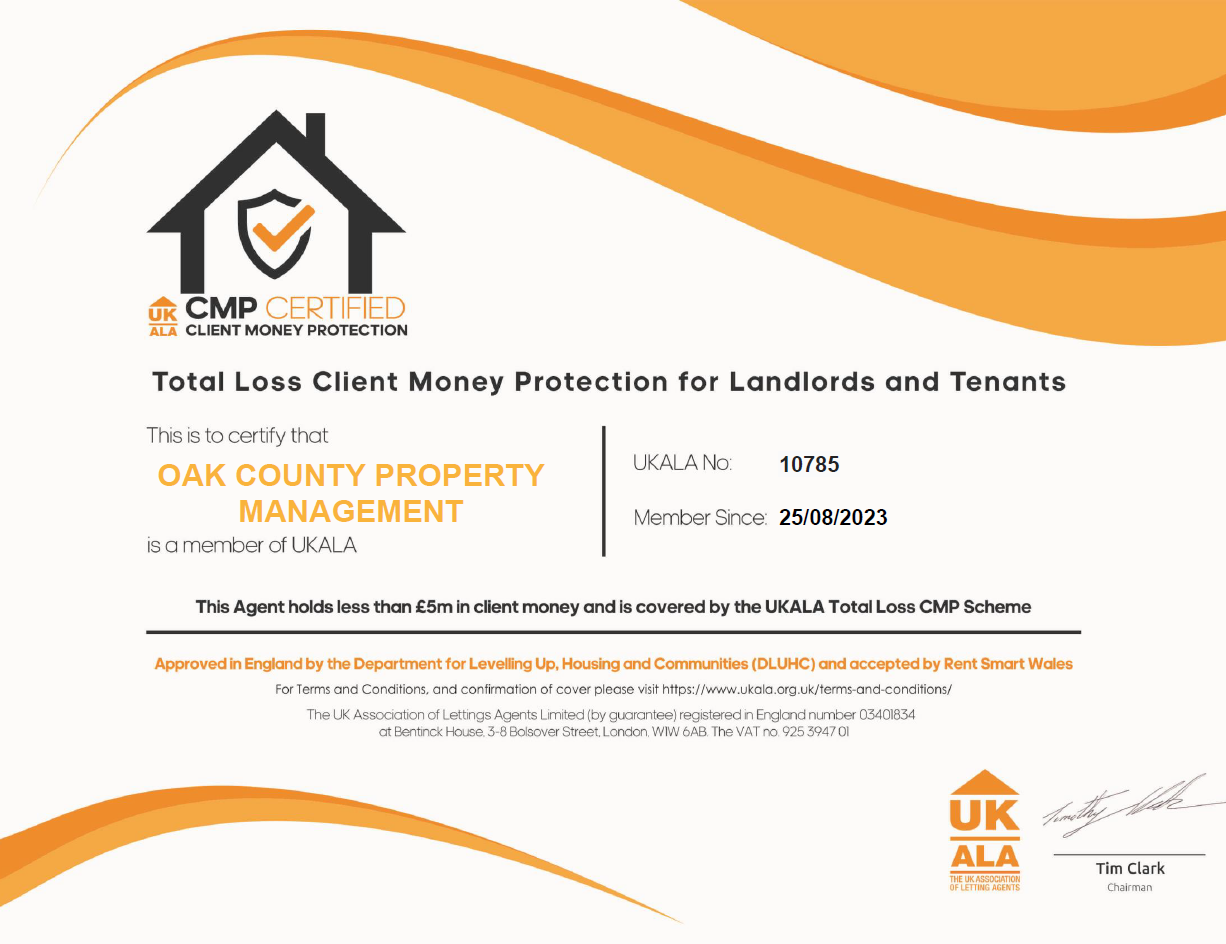

For a more detailed summary of the above visit 001 UKALA – Accounting Standard Letter (25 Oct 2022) copy